Build Your Credit Today!

Ranked #1 in Customer Satisfaction, controversial items removed.

Book a Confidential Session with a Credit Enhancement Experts

Build Your Credit Today!

Paving the Way for Financially Stable Families, One Credit at a Time!

Turning Credit Challenges into Opportunities for Every Household.

How Does Credit Repair Works?

Review Your

Credit Profile

We will analyze your detailed credit report. We will be looking for negative items like collections, charge-offs, tax liens, repossessions, judgments, and late payments.

Write to

Your Creditors

Correspondence is sent to your creditors directly. The letters are always sent via certified mail. The letters will include disputes, appeals, validation requests, and goodwill intervention.

Write to Your

Credit Agencies

Additional correspondence is sent to the 3 credit reporting agencies (Transunion, Equifax, and Experian) for immediate updates, deletions, and/or corrections.

Work with

Third Parties

Unlike other credit repair companies, we work with third-parties that serves as a second set of eyes in the credit repair process.

Unlimited

Negative Items

You can log in to our client portal and check your progress report, which will show you what has been removed and which items remain.

Watch

the Progress

A credit increase or a new credit card will help you in achieving the score that you deserve as you maintain a very low balance.

How Does Credit Repair Works?

Review Your Credit Profile

We will analyze your detailed credit report. We will be looking for negative items like collections, charge-offs, tax liens, repossessions, judgments, and late payments.

Write to Your Creditors

Correspondence is sent to your creditors directly. The letters are always sent via certified mail. The letters will include disputes, appeals, validation requests, and goodwill intervention.

Write to Your Credit Agencies

Additional correspondence is sent to the 3 credit reporting agencies (Transunion, Equifax, and Experian) for immediate updates, deletions, and/or corrections.

Work with Third Parties

Unlike other credit repair companies, we work with third-parties that serves as a second set of eyes in the credit repair process.

Unlimited Negative Items

You can log in to our client portal and check your progress report, which will show you what has been removed and which items remain.

Watch the Progress

A credit increase or a new credit card will help you in achieving the score that you deserve as you maintain a very low balance.

How to Start

Our credit repair process is designed to empower you on your journey to financial recovery.

Step 1: Consult with a Credit Specialist

The first step in the credit repair process is to speak with a credit specialist. This initial consultation will help you understand the state of your credit and identify areas that need improvement. A credit specialist will assess your credit report, discuss your financial goals, and provide personalized guidance on how to move forward.

Step 2: Convenient Enrollment Options

Once you have spoken with a credit specialist and decided to proceed with credit repair, you can enroll in the program either online or by phone. Enrolling is a straightforward process where you provide necessary information, such as your personal details and credit report. This step ensures that the credit repair company has all the necessary information to start working on your behalf.

Step 3: Initiating the Restoration Process

After enrolling, the credit repair company will begin the restoration process. This typically involves a thorough analysis of your credit report, identification of errors or inaccuracies, and development of a strategy to address them. The credit repair team will then initiate communication with credit bureaus, creditors, and collection agencies on your behalf to dispute and resolve any negative items that are harming your credit.

Step 4: Embrace a Brighter Financial Future

With the restoration process underway, you can start your journey towards a better financial future. As the credit repair company works diligently to remove errors, negotiate with creditors, and improve your credit standing, it's important to stay engaged and informed. Regularly check your progress and stay in touch with your credit specialist, who can provide updates, advice, and guidance along the way. As negative items are successfully removed and your credit improves, you'll be on your way to achieving financial goals and enjoying the benefits of a healthier credit profile.

How to Start

Our credit repair process is designed to empower you on your journey to financial recovery.

Step 1: Consult with a Credit Specialist

The first step in the credit repair process is to speak with a credit specialist. This initial consultation will help you understand the state of your credit and identify areas that need improvement. A credit specialist will assess your credit report, discuss your financial goals, and provide personalized guidance on how to move forward.

Step 2: Convenient Enrollment Options

Once you have spoken with a credit specialist and decided to proceed with credit repair, you can enroll in the program either online or by phone. Enrolling is a straightforward process where you provide necessary information, such as your personal details and credit report. This step ensures that the credit repair company has all the necessary information to start working on your behalf.

Step 3: Initiating the Restoration Process

After enrolling, the credit repair company will begin the restoration process. This typically involves a thorough analysis of your credit report, identification of errors or inaccuracies, and development of a strategy to address them. The credit repair team will then initiate communication with credit bureaus, creditors, and collection agencies on your behalf to dispute and resolve any negative items that are harming your credit.

Step 4: Embrace a Brighter Financial Future

With the restoration process underway, you can start your journey towards a better financial future. As the credit repair company works diligently to remove errors, negotiate with creditors, and improve your credit standing, it's important to stay engaged and informed. Regularly check your progress and stay in touch with your credit specialist, who can provide updates, advice, and guidance along the way. As negative items are successfully removed and your credit improves, you'll be on your way to achieving financial goals and enjoying the benefits of a healthier credit profile.

How We Improve Your Life

In today's world, your credit score is not just a number; it's a representation of your financial health and stability. It affects your ability to rent a home, buy a car, get a cell phone, and in many cases, it can even impact your employment opportunities. A good credit score does more than just unlock doors; it offers you flexibility, options, and peace of mind.

How We Improve Your Life

In today's world, your credit score is not just a number; it's a representation of your financial health and stability. It affects your ability to rent a home, buy a car, get a cell phone, and in many cases, it can even impact your employment opportunities. A good credit score does more than just unlock doors; it offers you flexibility, options, and peace of mind.

Our Pricing Options

Solo Flight Credit Repair

$147 Start Up

$97 Month to Month Fee

Personalized Credit Improvement Strategy

Direct Dispute Process with Credit Bureaus

Customized Dispute Letters

Unlimited Disputes

Unparalleled Customer Support

Tips and Strategies for Maintaining Improved Credit

Detailed Final Report with Credit Improvement Overview

Free Follow-up Consultation Post Service Completion

Most People See Results as Little as 90 Days

Results in 120 Days or Your Money Back

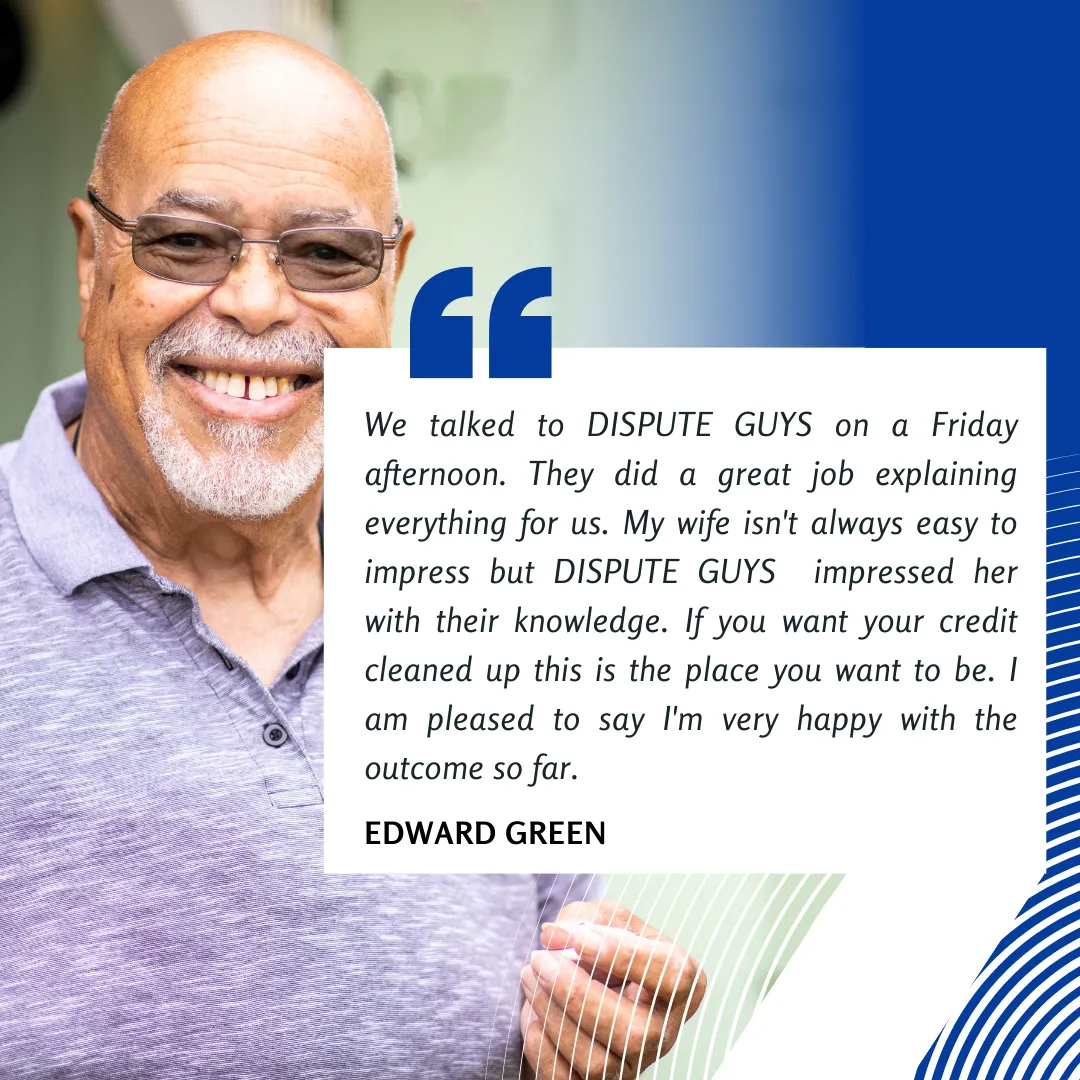

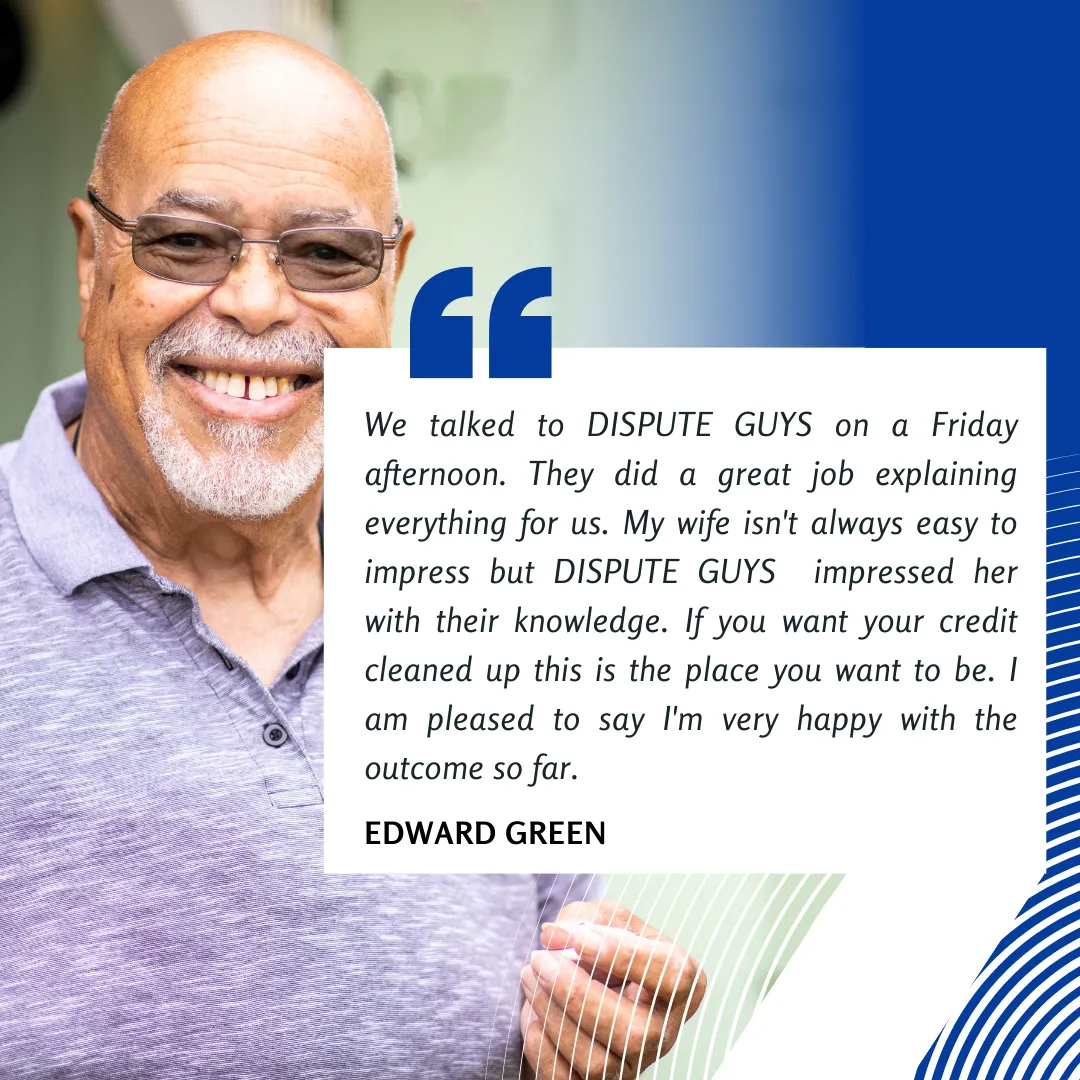

Couple's Credit Overhaul

$197 Start Up

$147 Month to Month Fee

Personalized Credit Improvement Strategy

Direct Dispute Process with Credit Bureaus

Customized Dispute Letters

Unparalleled Customer Support

Unlimited Disputes

Tips and Strategies for Maintaining Improved Credit

Detailed Final Report with Credit Improvement Overview

Free Follow-up Consultation Post Service Completion

Most People See Results as Little as 90 Days

Results in 120 Days or Your Money Back

One-and-Done Credit Repair

$497 One-Time Charge

One time charge

Personalized Improvement Strategy

Direct Dispute Process with Credit Bureaus

Tips and Strategies for Maintaining Improved Credit

Customized Dispute Letters

Unparalleled Customer Support

Detailed Final Report with Credit Improvement Overview

Free Follow-up Consultation Post Service Completion

Most People See Results as Little as 90 Days

Results in 120 Days or Your Money Back

Our Pricing Options

Solo Flight Credit Repair

$147 Start Up

☑️$97 Month to Month Fee

☑️Personalized Credit Improvement Strategy

☑️Direct Dispute Process with Credit Bureaus

☑️Customized Dispute Letters

☑️Unlimited Disputes

☑️Unparalleled Customer Support

☑️Tips and Strategies for Maintaining Improved Credit

☑️Detailed Final Report with Credit Improvement Overview

☑️Free Follow-up Consultation Post Service Completion

☑️Most People See Results as Little as 90 Days

☑️Results in 120 Days or Your Money Back

Couple's Credit Overhaul

$197 Start Up

☑️$147 Month to Month Fee

☑️Personalized Credit Improvement Strategy

☑️Direct Dispute Process with Credit Bureaus

☑️Customized Dispute Letters

☑️Unlimited Disputes

☑️Unparalleled Customer Support

☑️Tips and Strategies for Maintaining Improved Credit

☑️Detailed Final Report with Credit Improvement Overview

☑️Free Follow-up Consultation Post Service Completion

☑️Most People See Results as Little as 90 Days

☑️Results in 120 Days or Your Money Back

One-and-Done Credit Repair

$497 One-Time Charge Per Person

☑️One time charge

☑️Direct Dispute Process with Credit Bureaus

☑️Personalized Improvement Strategy

☑️Tips and Strategies for Maintaining Improved Credit

☑️Customized Dispute Letters

☑️Unparalleled Customer Support

☑️Detailed Final Report with Credit Improvement Overview

☑️Free Follow-up Consultation Post Service Completion

☑️Most People See Results as Little as 90 Days

☑️Results in 120 Days or Your Money Back

Results in 120 Days or Your Money Back

Check our Money Back Guarantee on how to qualify.

Results in 120 Days or Your Money Back

Check our Money Back Guarantee on how to qualify.

Frequently Asked Questions

Add some info

I've made financial mistakes in the past. Can your credit repair service help me regain control of my finances?

Absolutely! Our credit repair service is specifically designed to assist individuals like you in rebuilding their credit. We understand that everyone makes mistakes, and we're here to provide you with expert guidance, personalized strategies, and the tools you need to regain financial control and improve your creditworthiness.

How long does it typically take to see results from your credit repair service?

While each person's credit situation is unique, our experienced team works diligently to help you achieve results as quickly as possible. While some improvements can be seen in a matter of months, significant progress often takes time. However, with our proven strategies and ongoing support, you'll be on the path to a better credit score and financial future.

Can I repair my credit on my own, or do I need professional help?

Repairing your credit on your own is possible, but it can be a complex and time-consuming process. Our credit repair service offers you the advantage of working with experienced professionals who understand the intricacies of credit reporting and scoring. We have the expertise and resources to handle disputes, negotiate with creditors, and provide guidance tailored to your specific needs, giving you the best chance of success.

Will using your credit repair service guarantee that negative items will be removed from my credit report?

While we cannot guarantee specific outcomes, we are committed to employing every legal and ethical means available to improve your credit. Our team of experts will thoroughly analyze your credit report, identify inaccuracies or errors, and work diligently to dispute them with the credit bureaus. We have a high success rate in helping clients achieve the removal of negative items and a significant improvement in their credit profiles.

Can your credit repair service help me qualify for better loan terms or lower interest rates?

Absolutely! A better credit score opens doors to improved loan terms, lower interest rates, and increased financial opportunities. By repairing your credit and demonstrating responsible financial behavior, you can enhance your creditworthiness, making it easier to qualify for loans, mortgages, credit cards, and other financial products at favorable terms.

Is my personal and financial information safe with your credit repair service?

We take the security and confidentiality of your personal and financial information seriously. Our credit repair service adheres to strict industry standards and employs robust security measures to protect your data. We use encrypted connections, secure servers, and follow privacy best practices to ensure that your information remains safe and confidential throughout the credit repair process.

Frequently Asked Questions

Add some info

I've made financial mistakes in the past. Can your credit repair service help me regain control of my finances?

Absolutely! Our credit repair service is specifically designed to assist individuals like you in rebuilding their credit. We understand that everyone makes mistakes, and we're here to provide you with expert guidance, personalized strategies, and the tools you need to regain financial control and improve your creditworthiness.

How long does it typically take to see results from your credit repair service?

While each person's credit situation is unique, our experienced team works diligently to help you achieve results as quickly as possible. While some improvements can be seen in a matter of months, significant progress often takes time. However, with our proven strategies and ongoing support, you'll be on the path to a better credit score and financial future.

Can I repair my credit on my own, or do I need professional help?

Repairing your credit on your own is possible, but it can be a complex and time-consuming process. Our credit repair service offers you the advantage of working with experienced professionals who understand the intricacies of credit reporting and scoring. We have the expertise and resources to handle disputes, negotiate with creditors, and provide guidance tailored to your specific needs, giving you the best chance of success.

Will using your credit repair service guarantee that negative items will be removed from my credit report?

While we cannot guarantee specific outcomes, we are committed to employing every legal and ethical means available to improve your credit. Our team of experts will thoroughly analyze your credit report, identify inaccuracies or errors, and work diligently to dispute them with the credit bureaus. We have a high success rate in helping clients achieve the removal of negative items and a significant improvement in their credit profiles.

Can your credit repair service help me qualify for better loan terms or lower interest rates?

Absolutely! A better credit score opens doors to improved loan terms, lower interest rates, and increased financial opportunities. By repairing your credit and demonstrating responsible financial behavior, you can enhance your creditworthiness, making it easier to qualify for loans, mortgages, credit cards, and other financial products at favorable terms.

Is my personal and financial information safe with your credit repair service?

We take the security and confidentiality of your personal and financial information seriously. Our credit repair service adheres to strict industry standards and employs robust security measures to protect your data. We use encrypted connections, secure servers, and follow privacy best practices to ensure that your information remains safe and confidential throughout the credit repair process.

About Us

Dispute Guys Credit Repair Company aims to help families repair their credit, leverage credit effectively, and create generational wealth. The program focuses on three key areas: credit repair, financial literacy, and community empowerment. The company has established partnerships with non-profit housing development organizations to provide low-income housing and eventually assist clients in achieving homeownership.

Contact Us

info@disputeguys.com

+1( 240)-816-4303

210 Gilchrist, Fayette,

MS 39069

About Us

Dispute Guys Credit Repair Company aims to help families repair their credit, leverage credit effectively, and create generational wealth. The program focuses on three key areas: credit repair, financial literacy, and community empowerment. The company has established partnerships with non-profit housing development organizations to provide low-income housing and eventually assist clients in achieving homeownership.

Contact Us

📧 info@disputeguys.com

📞 +1( 240)-816-4303

📍 210 Gilchrist, Fayette, MS 39069